High Tech & High Touch Deliver the Child Tax Credit

In this episode of Add Passion and Stir, we are revisiting our Child Tax Credit series. We look at how...

About This Episode

In this episode of Add Passion and Stir, we are revisiting our Child Tax Credit series. We look at how organizations are using technology to make sure eligible families are receiving the credit. With more than 36 million additional children — a majority of whom are Black and Latino — now eligible and the credit being distributed as a monthly payment instead of an annual lump sum many changes were required to ensure success of the program. We spoke with Amanda Renteria, CEO of Code for America, who launched the GetCTC.org portal to make it easier for families to claim their credit and Jimmy Chen, CEO of Propel, the organization behind the Che app, which allows participants to manage a variety of government benefits, including the CTC, in one place about how they are helping to the credit reach all eligible families.Resources and Mentions:

Amanda Renteria

CEO

Amanda Renteria is CEO at Code For America. Immediately prior to joining Code For America, she was Chairwoman of the Board and Interim President at Emerge America, a non-profit organization that trains Democratic women to run for elected office at all levels of government. She has also served as the Chief of Operations at the California Department of Justice, National Political Director for Secretary Clinton, and the first Latina Chief of Staff in the United States Senate.

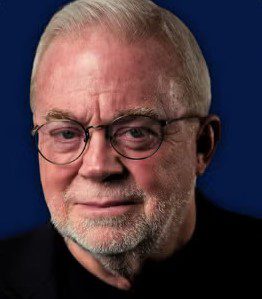

Jimmy Chen

Founder and CEO

Jimmy Chen is Founder and CEO at Propel, a software company that aims to fight poverty through technology. They are the creators of the Providers app (previously Fresh EBT), which enables EBT cardholders to manage their benefits, save money through grocery coupons, and find jobs. The app helps more than 2 million low-income Americans each month. Previously, Jimmy worked at Facebook, LinkedIn, and studied Symbolic Systems at Stanford.

Propel

https://www.joinpropel.com/Propel builds modern, respectful, effective technology that helps low-income Americans improve their financial health.

At Propel, we believe that tech hasn’t pulled its weight in solving real social problems. While tech alone won’t solve poverty, it can play a much larger role in building safety net services that restore financial health.

We believe that the best way to change the system for low-income Americans is to build a thriving business that aligns our incentives: a system where our business grows if and only if we help more low-income Americans improve their financial health.

Code For America

https://www.codeforamerica.orgCode for America believes government at all levels can and should work well for all people. They use insights and ideas from real people to guide us to real solutions that break down barriers to meet community needs and improve government in meaningful ways.

Get Your Child Tax Credit

https://www.getctc.org/enTo provide the Advance Child Tax Credit payments, the IRS needs to know current information about you and your children. If you have submitted a 2019 or a 2020 tax return, or if you used the IRS Non-filer Portal in 2020 to claim your stimulus payments, then the IRS has enough information to send your family your Advance Child Tax Credit payments automatically. If you have not submitted any information to the IRS in the last year, you can submit your information through GetCTC, a simplified tax filing portal, and get your payments.

Child Tax Credit

The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).